Identity theft is a serious crime with devastating consequences for victims, including damage to their credit score, difficulty obtaining loans or employment, and even legal troubles. In California, identity theft is a growing problem, with the state ranking among the top in the nation for reported cases of identity theft.

If you suspect someone stole your identity in California, act quickly to minimize the damage and protect your credit and financial well-being. In this blog post, we'll provide a step-by-step guide on how to report identity theft in California and what you can do to recover from this crime.

Step 1: Gather Evidence of the Theft

The first step in reporting identity theft in California is to gather evidence of the crime.

This may include:

- Credit card statements or bank statements showing unauthorized charges or transactions

- Bills or collection notices for accounts you did not open

- Notice from the IRS or state tax agency about suspicious tax returns filed in your name

- Denial of credit or employment due to fraudulent activity on your credit report

- Suspicious emails, texts, or social media messages related to the theft

Make copies of any relevant documents and keep detailed notes of any contacts with creditors, law enforcement, or government agencies related to the theft.

Step 2: Place a Fraud Alert on Your Credit Report

The next step is to place a fraud alert on your credit report with one of the three major credit bureaus: Equifax, Experian, or TransUnion. A fraud alert notifies creditors that they should take extra steps to verify your identity before granting credit in your name.

To place a fraud alert, contact one of the credit bureaus and request that an alert be placed on your credit report. The bureau you contact will notify the other two bureaus on your behalf. You will need to provide proof of your identity, such as a copy of your driver's license or Social Security card.

There are three types of fraud alerts you can place on your credit report:

- Initial fraud alert: This alert lasts for 90 days and is appropriate if you suspect you may be a victim of identity theft but have not yet confirmed it.

- Extended fraud alert: This alert lasts for seven years and is appropriate if you have confirmed that you are a victim of identity theft and have filed a police report.

- Active duty military alert: This alert lasts for one year and is appropriate if you are a member of the military and are deployed overseas.

Step 3: Order Your Credit Reports

After placing a fraud alert on your credit report, order copies of your credit report from each of the three credit bureaus. You may receive one free credit report from each bureau every 12 months, and you can request them online at www.annualcreditreport.com.

Review your credit reports carefully for any suspicious activity or accounts you don't recognize. If you find errors or fraudulent accounts, make a note of them and be prepared to dispute them with the credit bureaus and the creditors involved.

Step 4: File a Police Report

If you have confirmed that you are a victim of identity theft, file a police report with your local law enforcement agency. This creates an official record of the crime and may be necessary for disputing fraudulent accounts or seeking legal remedies.

When filing a police report, provide as much information as possible about the theft, including any evidence you have gathered and any contacts you have had with creditors or government agencies. Ask for a copy of the police report, as you may need it for future reference.

Step 5: Report the Theft to the Federal Trade Commission

In addition to filing a police report, report the identity theft to the Federal Trade Commission (FTC). The FTC maintains a database of identity theft complaints and provides resources for victims, including an Identity Theft Report that can be used to help prove your case to creditors and government agencies.

To report identity theft to the FTC, visit www.identitytheft.gov and follow the instructions for filing a complaint. You will need to provide detailed information about the theft, including any evidence you have gathered and any contacts you have had with creditors or law enforcement.

Step 6: Contact Creditors and Financial Institutions

If you have discovered fraudulent accounts or transactions on your credit report or financial statements, contact the creditors or financial institutions involved immediately. Inform them that you are a victim of identity theft and request that they close the fraudulent accounts and reverse any charges.

You may need to provide a copy of your police report or Identity Theft Report to prove your case. Keep detailed records of all contacts with creditors and financial institutions, including the names of representatives you spoke with and any correspondence you sent or received.

Step 7: Consider a Credit Freeze

In addition to placing a fraud alert on your credit report, place a credit freeze. A credit freeze prevents anyone from accessing your credit report without your permission, making it much harder for identity thieves to open new accounts in your name.

To place a credit freeze, contact each of the three credit bureaus separately and request that a freeze be placed on your credit report. You may need to provide proof of your identity and pay a small fee, but the fee is waived if you are a victim of identity theft and have filed a police report.

Keep in mind that a credit freeze can make it more difficult for you to apply for credit or open new accounts, as you will need to temporarily lift the freeze each time you want to allow a creditor to access your credit report.

However, a credit freeze can provide an extra layer of protection against identity theft and is worth considering if you have been a victim of this crime.

Step 8: Monitor Your Credit and Financial Accounts

After reporting identity theft and taking steps to protect your credit, it's important to continue monitoring your credit report and financial accounts for any signs of ongoing fraudulent activity. This may include:

- Reviewing your credit report regularly for any new accounts or inquiries you don't recognize

- Checking your bank and credit card statements for any unauthorized transactions

- Setting up alerts with your bank or credit card company to notify you of any suspicious activity

- Considering a credit monitoring service that can alert you to changes in your credit report

If you discover any new fraudulent activity, report it immediately to the appropriate agencies and take steps to dispute it with the creditors involved.

Step 9: Seek Legal Assistance

If you have been a victim of identity theft and are facing legal troubles or difficulties resolving disputes with creditors, consider seeking the assistance of a qualified attorney who handles identity theft cases.

An attorney can protect your rights and seek remedies for any damages you have suffered as a result of the theft.

Step 10: Take Steps to Prevent Future Theft

Finally, after recovering from identity theft, take steps to prevent future theft and protect your personal information. This may include:

Use Strong, Unique Passwords and Enable Two-Factor Authentication

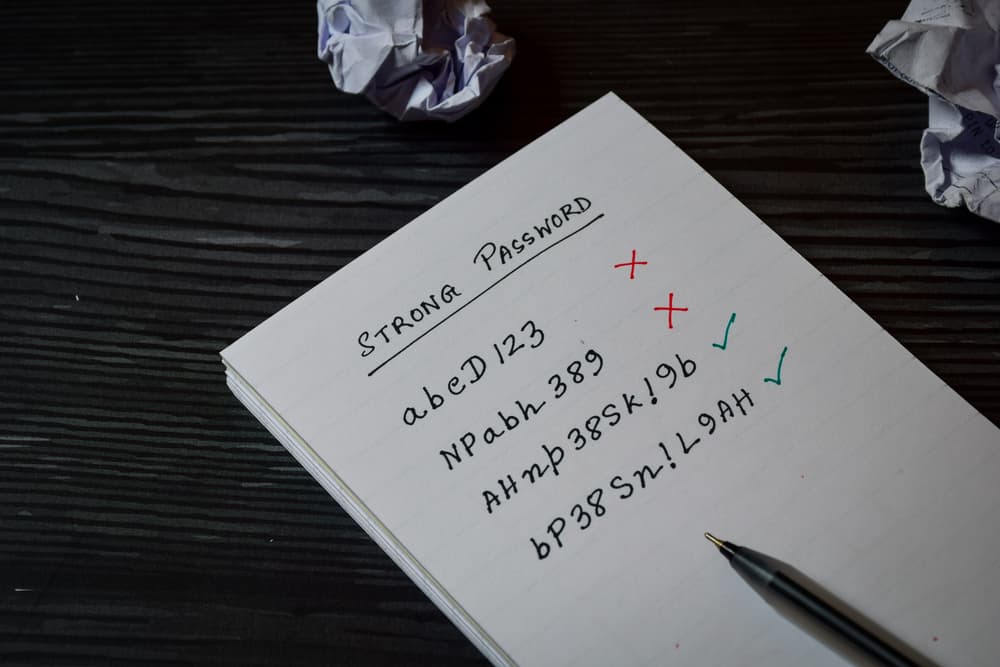

One of the most important steps you can take to prevent identity theft is to use strong, unique passwords for all of your online accounts and enable two-factor authentication whenever possible.

A strong password should be at least 12 characters long and include a mix of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information, such as your birthdate, phone number, or common words.

Use a different password for each of your online accounts. This way, if one of your accounts is compromised, the thief cannot access your other accounts using the same password.

To make it easier to create and remember strong, unique passwords, consider using a password manager tool. These tools can generate complex passwords for you and store them securely, so you don't have to remember them all yourself.

In addition to using strong passwords, enable two-factor authentication (2FA) on your accounts whenever possible. 2FA adds an extra layer of security by requiring a second form of identification, such as a code sent to your phone or email, in addition to your password.

Many online services, including email providers, social media platforms, and financial institutions, offer 2FA as an optional security feature. By enabling 2FA, you can make it much harder for identity thieves to access your accounts, even if they have your password.

Be Cautious About Sharing Personal Information

Another key step in preventing identity theft is not to share your personal information online or over the phone, especially if you didn't initiate the contact.

Identity thieves often use phishing scams and social engineering tactics to trick people into revealing sensitive information, such as their Social Security number, credit card number, or login credentials.

They may pose as a legitimate company or government agency and use urgent or threatening language to pressure you into providing your information.

To protect yourself from these scams, be wary of unsolicited emails, phone calls, or text messages that ask for your personal information. If you receive a message that seems suspicious, don't click on any links or download any attachments. Instead, contact the company or agency directly using a phone number or email address you trust to verify the request.

When sharing personal information online, make sure you are using a secure website with "https" in the URL and a lock icon in the browser bar. Avoid sharing sensitive information over public Wi-Fi networks, which can be easily hacked by identity thieves.

If you don’t know whether a request for your personal information is legitimate, err on the side of caution and don't provide it.

Shred or Destroy Sensitive Documents

Identity thieves often go through people's trash looking for sensitive documents that contain personal information, such as credit card offers, bank statements, and utility bills. To prevent this, shred or destroy these documents before throwing them away.

Invest in a cross-cut shredder that can shred documents into small, confetti-like pieces that are difficult to reassemble. Shred any documents that contain your name, address, phone number, Social Security number, or financial information.

If you don't have a shredder, you can also tear the documents into small pieces by hand or use scissors to cut them up. Just make sure the pieces are small enough that they can't be easily reassembled.

In addition to shredding documents, be sure to destroy any old credit cards, driver's licenses, or other identification cards that you no longer need. Cut them up into small pieces or run them through a shredder before disposing of them.

By taking these steps to destroy sensitive documents and identification cards, you can make it much harder for identity thieves to access your personal information and use it for fraudulent purposes.

Consider a Credit Monitoring or Identity Theft Protection Service

For added security and peace of mind, you may want to consider signing up for a credit monitoring or identity theft protection service.

These services can help you stay on top of your credit report and financial accounts by alerting you to any changes or suspicious activity. They may also provide additional features, such as identity restoration services and insurance coverage for lost wages or legal fees related to identity theft.

When choosing a credit monitoring or identity theft protection service, look for one that offers comprehensive coverage and a good reputation for customer service. Some popular options include LifeLock, Identity Guard, and IdentityForce.

Keep in mind that these services typically charge a monthly or annual fee, so be sure to compare prices and features before signing up. Some services may also offer free trials or money-back guarantees, so you can try them out before committing to a long-term subscription.

Contact a Consumer Protection Attorney

If you suspect that you are a victim of identity theft, act quickly to minimize the damage and protect your credit and financial well-being.

By following the steps outlined in this blog post, including gathering evidence, placing a fraud alert on your credit report, filing a police report, and contacting creditors and government agencies, you can take control of the situation and begin the process of recovering from identity theft.

Remember, recovering from identity theft can be a long and challenging process, but you don't have to go through it alone. Seek the assistance of law enforcement, government agencies, and a qualified California consumer protection attorney who can provide guidance and support throughout the process.